Investment proposition

Stoneweg European Real Estate Investment Trust (“Stoneweg European REIT” or “SERT’) offers the opportunity to invest in attractive European freehold commercial real estate with a trusted Manager and experienced local Property Manager.

Investment strategy

SERT has a principal mandate to invest, directly or indirectly, in income-producing commercial real estate assets across Europe with a minimum portfolio weighting of at least 75% to Western Europe and at least 75% to the light industrial / logistics and office sectors. SERT currently targets maintaining majority investment weighting to the logistics / light industrial sector while also investing in core office assets in gateway cities

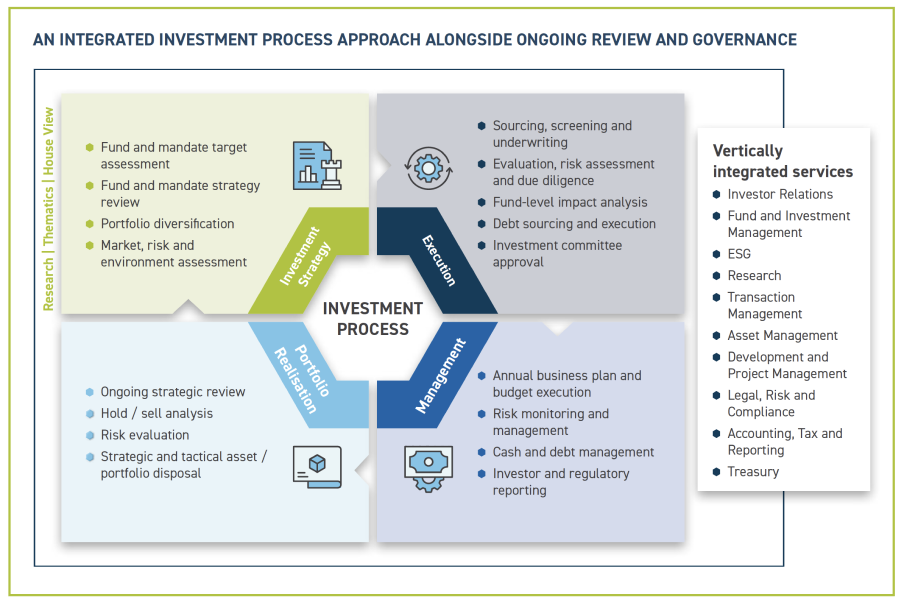

The Manager aims to achieve SERT’s objectives through executing on the following key strategies:

Active asset management and asset rejuvenation

Capital recycling, sustainable developments and AEIs

Responsible capital management

High ESG standards and disclosures